Annual Compliance Trends Survey Results Released

Holley Nethercote is excited to present our third Compliance Trends Survey Report. This survey was conducted in February 2025 across over 200 Australian financial services and Australian credit licence holders.

While the top regulatory concerns have remained consistent in our Compliance Trends Survey for the three years we have run it, this year showed some notable changes in compliance trends, especially in relation to spending and investment.

Cybersecurity remains the largest specific compliance risk and concern for licensees, reflecting the visibility and impact of this issue in the wider community and the speed with which new threats are emerging and evolving. There is also an increasing community sentiment that service providers have a responsibility to take active steps to protect clients from scams and hacking. This means that the ability to proactively identify and address cyber threats is becoming increasingly important.

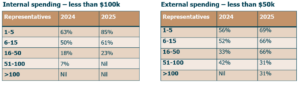

This year’s survey report highlights a significant decrease in spending by licensees on compliance. Forty percent of respondents are now spending less than $100,000 on internal compliance staff, compared to 29% in 2024. Spending on external compliance has seen a similar decline, with 57% of respondents spending less than $50,000 on external compliance, compared to 39% in 2024.

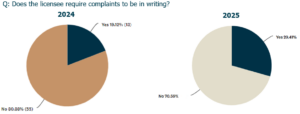

This year saw a growing number of respondents requiring complaints to be made in writing, despite this not being a legal requirement.

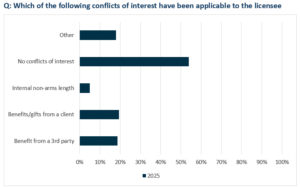

There are still a large (albeit decreasing) number of licensees that continue to disclose no conflicts of interest. The regulatory system works on an assumption that conflicts of interest are to be expected and managed. We would be surprised to find such a large number of financial services businesses that really do not have any conflicts of interest.

The survey responses in relation to risk management indicate that many licensees still do not fully understand how risk management systems should operate. In that regard, we note that this is an area where ASIC still provides little regulatory guidance. However, we see this as an area of increasing regulatory focus. A topical example being the varied risks that arise from the use of outsourced service providers.

Not surprisingly, the survey noted a significant increase in the use of AI among respondents. In 2024, only 10% of respondents were using AI for minute-taking, but in 2025, this increased to 46%. More than half of respondents use AI to record meetings. However, 20% still do not use AI and have no plans to do so. It would be interesting to see if this is due to non-usage or lack of awareness by compliance teams.

To access the full report please visit HN Hub.

Author: Kath Bowler, General Manager

Do you want to know more?

| Contact Us | Our Expert Team | Our Training |