The big issue with issuing – Can it be done without holding an AFSL?

Under the financial services laws, a person that carries on a financial services business must hold an AFSL covering the provision of those services, unless an exemption applies.

Issuing a financial product is a financial service and, therefore, would seem to require the issuer to hold an AFSL. However, two licensing exemptions are potentially applicable to the issuing of financial products. These exemptions are:

The exact application of these exemptions to the issuing of financial products has, up to now, not been entirely clear. Further uncertainty has arisen due to ASIC taking a restrictive interpretation of both exemptions in its public policy guidance.

Recent enforcement action by ASIC in the Federal Court has now examined the application of both exemptions, and the purpose of this article is to take a fresh look at the operation of each exemption in light of the judgements in that litigation.

The authorised representative exemption

An exemption to the requirement to hold an AFSL applies to a person who provides a financial service as an authorised representative of a licensee, provided the licensee’s AFSL covers the provision of the service.[iii]

While this provision would appear to cover the financial service of issuing financial products (to the extent that the licensee itself can do so), ASIC has long held a position that an issuer of a financial product cannot issue the product as an authorised representative.

In particular, ASIC has stated that it considers the action of issuing, varying or disposing of an interest in a managed investment scheme as a trustee is, by its nature, the action of a principal.[iv]

Until now there has been little case law that either supports or contradicts ASIC’s stated position.

The BPS case

In ASIC v BPS Financial,[v] the Federal Court was asked to consider whether BPS carried on a financial services business in Australia in contravention of the Corporations Act 2001 (“the Act”), being a business of:

- dealing in a financial product, being the Qoin Wallet; and

- providing financial product advice in relation to the Qoin Wallet,

when BPS did not hold an AFSL covering the provision of those financial services.

BPS had developed and marketed a facility for making non-cash payments using a digital currency or crypto asset named “Qoin” – which was a notional unit of exchange in transactions undertaken through the “Qoin Wallet”.

At first instance, the primary judge found that BPS was exempt from the requirement to hold an AFSL because BPS was providing financial services as an authorised representative of a licensee (“PNI”) that held an AFSL that covered the financial services provided by BPS.[vi]

ASIC then appealed from this aspect of the primary judge’s findings.

On appeal, the Full Federal Court held that BPS was not issuing a financial product “as a representative” of PNI and was, therefore, unable to rely on the licensing exemption available to authorised representatives acting on behalf of a licensee.

In the appeal, ASIC submitted that the person claiming the exemption must provide the service “as representative of” a second person who holds an AFSL which covers the provision of the service.

The Full Court held that whilst the primary judge was correct to reason that the legislation permits an AFSL holder to determine the content and scope of the authority granted to an authorised representative, it does not follow that every act of the authorised representative in providing the relevant financial service is provided in that capacity. Whether the authorised representative’s conduct is in that capacity will depend on the facts.

The Full Court held that the evidence established that BPS was not issuing the Qoin product in its capacity as a representative of PNI but was in substance doing so in its own right and on its own behalf.

There were several facts that supported this conclusion.

- BPS had developed the Qoin product well before it had any dealings with PNI.

- BPS had been issuing the Qoin product without holding an AFSL prior to the PNI authorisations, though it had been purporting to issue that product as an authorised representative of another AFSL holder.

- The principals of BPS sought out AFSL holders for the very reason that they could not issue the Qoin product without a licence.

- All of the relevant documents relating to the issue of the Qoin product were prepared and issued by BPS well before any of its dealings with PNI and did not refer to PNI or any other AFSL holder.

- The relevant contractual relationship was that between BPS and relevant users, and the terms of use contemplated the user conferring contractual rights on, and assuming contractual obligations owed to, BPS in its own right.

- Despite some evidence that PNI had taken steps towards monitoring BPS’ services by preparing a compliance plan, holding monthly compliance meetings, and apparently maintaining document control over the PDS, this did not lead to the conclusion that BPS actually provided the financial services in its capacity as an authorised representative of PNI.

The Full Court held that, in issuing the Qoin product, BPS was acting on its own behalf and not as a representative of PNI. The Court also noted that the outcome of the appeal was “peculiar to the facts” and declined to consider more generally the situations where an authorised representative could be an issuer of a financial product.

While the case resulted in a win for ASIC, it did not, ultimately, hold that an authorised representative could never issue a financial product. However, given the above list of facts that the Full Court took into account, it is difficult to envisage a situation where an issuer would not be acting on its own behalf. It also raises questions as to whether the same principle applies to other financial services – such as the giving of advice by a product issuer.

Intermediary arrangements

While the appointment of an authorised representative can, theoretically at least, cover any type of financial service, there is a specific exemption that applies only to the “issue, variation or disposal” of financial products. This is generally referred to as the “intermediary exemption”.

Under that exemption, a product provider is exempt from the requirement to hold an AFSL to issue, vary or dispose of a financial product in certain limited circumstances. It permits an unlicensed issuer of financial products to engage the services of an AFSL holder or its representatives to distribute their product.

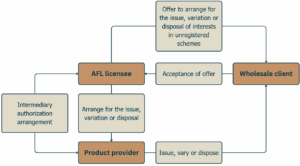

This exemption only applies where a product provider has an intermediary authorisation arrangement in place with an AFSL holder under which:

- the AFSL holder or its authorised representative may make offers to people to arrange for the issue, variation or disposal of financial products by the product provider;

- the product provider is to issue, vary or dispose of the financial products in accordance with such offers, if they are accepted; and

- the offer under which the issue, variation or disposal is made, was covered by the licence of the AFSL holder.

ASIC has, for a long time, been unhappy with the use of this exemption – particularly in the area of issuing interests in unregistered managed investment schemes.

ASIC’s concerns arose out of a practice that had developed of appointing the product issuer as the authorised representative to make the offers mentioned in the first bullet point above. ASIC subsequently issued an information sheet[vii] stating its view that the authorised representative could not be the product provider.

ASIC’s view on this point has now been confirmed by the decision in the BPS case.

The diagram below illustrates an example acceptable to ASIC where the trustee of an unregistered scheme, as product provider, relies on the exemption. In this example, the AFSL holder makes the offer to arrange for the issue, variation or disposal of interests in the unregistered scheme. The trustee issues, varies or disposes of the interest as the product provider.

Holley Nethercote Lawyers is able to assist with advice on the application of both exemptions and with the establishment and documenting of intermediary authorisation arrangements. Please also speak to us about how the BPS decision may impact on arrangements that you currently have in place.

Author: David Court (Partner)

| Contact Us | Our Expert Team | Our Training |

[i] Section 911A(2)(a) of the Act.

[ii] Section 911A(2)(b) of the Act.

[iii] Section 911B(1)(b) of the Act.

[iv] AFS licensing requirement for trustees of unregistered managed investment schemes | ASIC

[v] Australian Securities and Investments Commission v BPS Financial Pty Ltd [2025] FCAFC 74.

[vi] BPS had earlier been appointed as an authorised representative of another licensee that did not have issuing of a non-cash payment facility on its licence which, self evidently, failed to meet the requirements of the authorised representative exemption.

[vii] AFS licensing requirement for trustees of unregistered managed investment schemes | ASIC