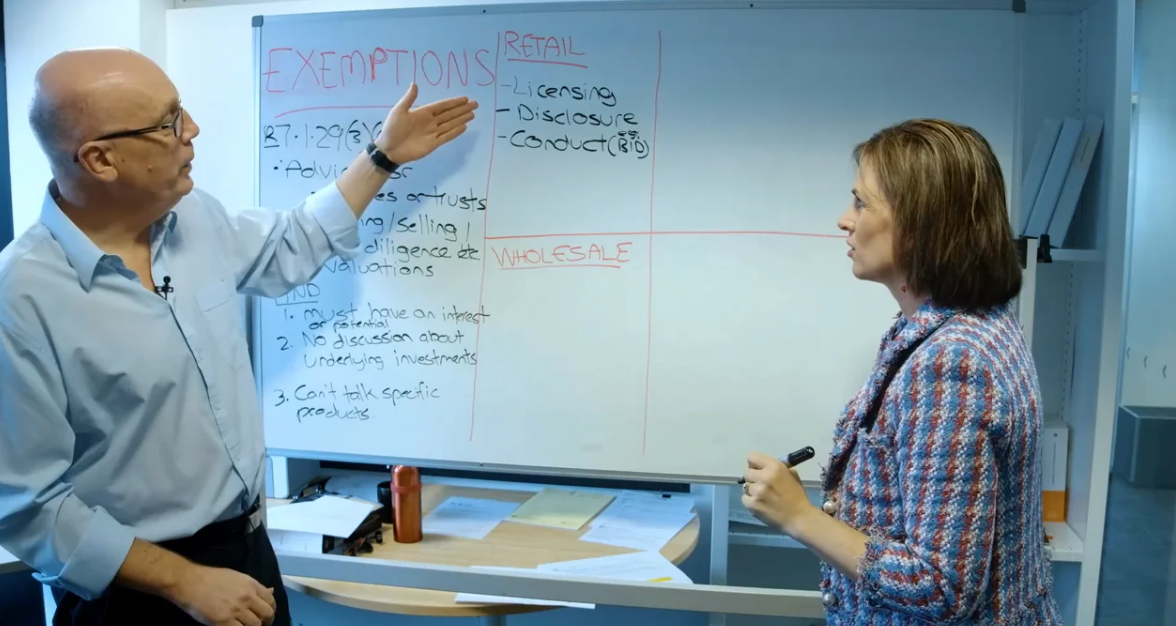

Wholesale vs Retail Clients Explained

A person is either a wholesale client or a retail client in relation to a particular financial product or service. However, the distinction is complicated and a person can be both type of client at the same time in relation to different products and services.

What is a Retail Client?

Retail clients are considered by law as less financially literate than their wholesale counterparts. The law requires financial services providers to meet a wide range of prescriptive disclosure, dispute resolution, training, product design and conduct requirements when dealing with retail clients that do not apply to wholesale clients.

What is a Wholesale Client?

According to sections 708 and 761G of the Corporations Act 2001, there are 5 eligibility tests to determine whether or not a client is eligible to be considered wholesale.

Particular considerations for SMSF clients

Subject to our comments below, SMSFs can only be treated as wholesale when the advice is being provided to the trustee, rather than the member. As with all trust situations, it is the trustee that must meet the eligibility test for wholesale advice, not the trust.

Where the SMSF has a corporate trustee, then the company is the client and it is the status of the company that needs to be considered.

Where the SMSF has individual trustees, then the client is the joint individual trustees. It is crucial in this regard to keep in mind that individual trustees must be considered as a joint entity and not as the sum of their individual circumstances.

The individual wealth tests have been frequently used by financial advisers for SMSFs as they are relatively straightforward tests. The adviser can rely on the certification provided by the accountant and the control tests can be used to include net assets or income held in controlled entities.

However, it should be kept in mind that the net assets of a trustee will likely be only a nominal amount (unless it also holds non-trust assets) because of the need to recognise the liability which represents the interests that the beneficiaries have in the assets of the trust. For this reason, the control test becomes important – it permits the net assets of the trust to be counted rather than the net assets of the trustee. While it is relatively easy to ascertain control over a family trust, it is more difficult in relation to an SMSF due to the structure which those funds must take.

That said, it should also be noted that, where a financial service ‘relates to a superannuation product’, a trustee of an SMSF will be classified as a retail client unless the SMSF holds net assets of at least $10 million at the time the service is provided. Accordingly, the meaning of the expression ‘relates to a superannuation product’ has become a key area of uncertainty when treating the trustee of an SMSF as a wholesale client.

In August 2014, ASIC issued Media Release 14-191MR which set out the following ‘no action’ position:

‘….where the trustee of an existing superannuation fund receives advice about how to invest the fund’s assets, ASIC will not take action if the person providing the advice determines whether the trustee is a wholesale client based on the general test mentioned above (e.g. if the trustee has net assets of at least $2.5 million), rather than applying the higher $10 million net asset test. ASIC will adopt a similar approach to a trustee who subscribes for financial products on behalf of an existing fund.’

Following ASIC Media Release 14-191MR, it was generally accepted in the financial services industry that all of the wholesale client eligibility tests were available to an SMSF where the advice related to the investment of the SMSF’s assets (that is, the advice ‘relates to’ underlying securities, derivatives or real property, etc. – and not to superannuation itself).

However, AFCA has taken a narrower view of what ‘relates to a superannuation product’ means. AFCA’s view appears to be that a financial service will ‘relate to a superannuation product’ (including an SMSF) where there is a connection between the financial service and the superannuation product. AFCA has stated that the words ‘relates to’ have an extremely wide meaning and that ‘the phrase can refer to a direct or indirect connection between two subjects’.

AFCA’s position appears to be that, where financial services are provided to an SMSF that does not have at least $10 million in net assets at the time the financial services are provided, the individual wealth and sophisticated investor tests are inapplicable and the SMSF will be a retail client on the basis that the financial services provided to the SMSF ‘relate to a superannuation product’.

The different approaches taken by ASIC and AFCA in relation to this issue are, obviously problematic for advisers and product issuers dealing with wholesale clients. In the absence of a Court decision on this point or legislative intervention, the ‘safe harbour’ position would be to treat SMSF clients as retail clients when providing them with financial services.

Eligibility to be a Wholesale Client is determined by meeting one of the 5 eligibility tests:

- Product value – of over $500,000

- Individual wealth – measured in terms of gross income or net assets as certified by an accountant’s certificate

- Professional investors – mostly institutional investors and investment managers

- Large businesses – as measured by number of employees

- Sophisticated investor – as determined by an AFSL holder based on the client’s investment experience.

Again, the criteria applying to each test is complicated and not all tests can be used in all situations. Applying the tests to entities such as trusts (and particularly SMSFs) can also raise difficulties.

Simply meeting an eligibility test might also not be sufficient as regulators are increasingly taking the view that classifying clients with low levels of financial literacy as wholesale might result in a breach of other regulatory obligations (such as those relating to acting fairly).

What is a Sophisticated Investor and what is the Sophisticated Investor Test?

Sophisticated investors are persons that an AFS licensee has determined to be experienced in using financial services.

The Sophisticated Investor test consists of 5 elements which can be summarised as follows:

- the product is not a general insurance product, a superannuation product or an RSA product;

- the product or financial service is not used in connection with a business;

- the licensee is satisfied on reasonable grounds that the client has previous experience in using financial services and investing in financial products that permits the client to assess a range of specified factors;

- the licensee gives to the client a written statement of its reasons for being so satisfied; and

- the client signs a written acknowledgement in relation to certain matters.

What are the Individual Wealth Tests?

Individual Wealth tests require a person to have:

- net assets of at least $2.5 million; or

- gross income for each of the last 2 financial years of at least $250,000, as certified by an accountant. The certificate lasts for 2 years before requiring renewal.

In determining the net assets or gross income of a person, the net assets or gross income of a company, or trust controlled by that person, can be included. Similarly, if a person is eligible to be a wholesale client, then a company or trust controlled by that person is also a wholesale client.

How we can help

Our team of experts have extensive experience in this area:

- provide legal advice in relation to the application of the eligibility tests

- provide legal advice in relation to the effect of wholesale client status on your conduct and disclosure obligations

- provide legal advice in relation to product design for wholesale products

- prepare documentation for assessing wholesale client eligibility (such as application forms and sophisticated investor letters)

- assist with AFSL applications for wholesale only businesses

Want to learn more about Wholesale vs Retail clients?

Reading material

- Wholesale Client Eligibility – Sophisticated Investor and Individual Wealth Tests

- Are changes coming to the wholesale client eligibility rules?

- RG 132: Compliance systems for Wholesale Managed Funds

- Retail vs Wholesale Clients – Regulatory Concerns & Responses

- The Royal Commission – a missed opportunity for Wholesale Clients?

- Is the end coming for the Sophisticated Investor?

- Certified Wholesale – SMSFs and Accountant’s Certificates

- What the Storm Financial case told us about wholesale client eligibility